The housing market in 2025 is set for a shift. Zillow lowered its home value…

DSCR Vacation Rentals: A Smart Investment Strategy

DSCR Vacation Rentals is a powerful strategy that many investors know of but that new investors do not.

Debt Service Coverage Ratio (DSCR) is a crucial term for real estate investors, particularly those looking to expand their portfolios with short-term rental properties. This blog post will walk you through a detailed example of a DSCR loan applied to a vacation rental property in San Diego, California.

What is DSCR?

DSCR stands for Debt Service Coverage Ratio, a metric used by lenders to evaluate the ability of an investment property to cover its debt obligations. It is calculated by dividing the property’s net operating income by its total debt service. A DSCR of 1 or higher indicates that the property generates sufficient income to cover its debt obligations, making it a viable investment.

Why DSCR Loans for Short-Term Vacation Rentals?

DSCR loans are particularly attractive for investors looking at short-term rental properties. These loans consider the rental income potential of the property rather than the borrower’s personal income, making it easier for investors to qualify.

Case Study: A Hypothetical Vacation Rental in San Diego

Let’s dive into a real-world example to understand the mechanics of a DSCR loan for a short-term rental property.

Property Details:

- Location: San Diego, California

- List Price: $1,299,950

- Estimated Rental Income (AirDNA Report): $148,600 annually

Step-by-Step Analysis

1. Purchase and Loan Details: The investor makes an offer for $1.27 million, requiring a 25% down payment. This down payment is typical for DSCR loans catering to short-term rentals.

- Down Payment: 25% of $1.27 million = $317,500

- Loan Amount: 75% of $1.27 million = $956,250

2. Loan Terms: The interest rate for this DSCR loan type is higher than traditional loans, averaging around 8.2%.

- Monthly Principal and Interest Payment: $7,353

- All-In Monthly Payment (including taxes, insurance, and association dues): $8,981

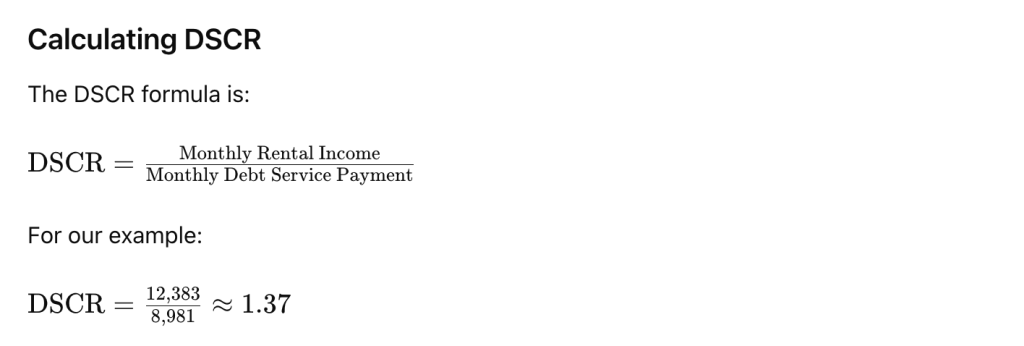

3. Rental Income: Based on the AirDNA report, the property’s estimated monthly rental income is $12,383.

A DSCR of 1.37 indicates that the property generates 1.37 times the income needed to cover its debt obligations, making it a solid investment.

Key Considerations for DSCR Loans

1. Down Payment and Reserves:

- DSCR loans for short-term rentals often require a higher down payment (25%).

- Lenders also look for reserves equivalent to 6-12 months of mortgage payments.

2. Credit Score and Assets:

- A good credit score and sufficient assets are crucial for qualifying.

- The borrower’s income is less significant since the focus is on the property’s rental income.

3. Interest Rates:

- Interest rates for DSCR loans are generally higher than traditional loans.

- Rates can fluctuate, so it’s essential to stay updated.

4. Prepayment Penalties:

- DSCR loans may come with prepayment penalties ranging from 0 to 5 years, with 3 years being most common.

- Borrowers can opt to buy out the prepayment penalty for more flexibility.

Long-Term Strategy and Benefits

1. Refinancing Opportunities:

- If the property cash flows well at current interest rates, future rate drops can enhance profitability through refinancing.

2. Equity Stripping:

- Investors can use cash-out refinancing to extract equity and invest in additional properties, thereby growing their portfolios.

Conclusion

DSCR loans provide a fantastic opportunity for real estate investors, particularly those focused on short-term rentals. By understanding the key components—credit score, assets, and property cash flow—you can leverage DSCR loans to build wealth over time.

If you have any questions or need assistance with DSCR loans, feel free to reach out. Our team is licensed in multiple states and has access to a wide range of DSCR lenders to help you achieve your investment goals.

FAQ: Understanding DSCR Vacation Rentals

Q1: What is DSCR?

A1: DSCR stands for Debt Service Coverage Ratio. It’s a metric used by lenders to assess whether a property generates enough income to cover its debt obligations. It is calculated by dividing the property’s net operating income by its total debt service.

Q2: Why are DSCR loans popular among real estate investors?

A2: DSCR loans are popular because they focus on the rental income potential of the property rather than the borrower’s personal income. This makes it easier for investors to qualify for loans and expand their portfolios.

Q3: Can DSCR loans be used for short-term rentals?

A3: Yes, there are specific DSCR loans designed for short-term rentals. These loans consider the income generated from short-term rentals, making them an attractive option for investors in vacation rental properties.

Q4: What kind of down payment is required for a DSCR loan on a short-term rental property?

A4: Typically, a 25% down payment is required for DSCR loans on short-term rental properties. This is higher than the down payment for traditional DSCR loans, which might be lower if the property cash flows well.

Q5: Do DSCR loans require reserves?

A5: Yes, lenders usually require reserves equivalent to 6-12 months of mortgage payments. This ensures that the borrower has sufficient funds to cover payments in case of income fluctuations.

Q6: How is the interest rate for a DSCR loan determined?

A6: Interest rates for DSCR loans are generally higher than those for traditional loans. The rates can fluctuate daily, so it’s important to stay informed. In the provided example, the interest rate is around 8.2%.

Q7: What is the DSCR formula?

A7: The DSCR formula is: DSCR=Monthly Rental IncomeMonthly Debt Service Payment\text{DSCR} = \frac{\text{Monthly Rental Income}}{\text{Monthly Debt Service Payment}} A DSCR of 1 or higher indicates that the property generates enough income to cover its debt obligations.

Q8: What DSCR is considered good for a loan?

A8: A DSCR of 1 or higher is generally considered acceptable. For short-term rental DSCR loans, a DSCR of 1.25 or higher is often required. In the example provided, the DSCR is 1.37, which is considered very good.

Q9: Are there any prepayment penalties for DSCR loans?

A9: Yes, DSCR loans often come with prepayment penalties ranging from 0 to 5 years, with 3 years being the most common. Borrowers can opt to buy out the prepayment penalty for added flexibility.

Q10: Can DSCR loans be refinanced? A10: Yes, DSCR loans can be refinanced, which can be beneficial if interest rates drop. Refinancing can reduce borrowing costs and improve cash flow.

Q11: What are the main criteria to qualify for a DSCR loan?

A11: The three main criteria are:

- Sufficient cash flow from the property

- Necessary assets for the down payment and reserves

- A good credit score

Q12: Can DSCR loans be obtained in the name of an LLC?

A12: Yes, DSCR loans can be obtained in either an individual’s name or an LLC’s name, making them flexible for investment purposes.

Q13: How can I use a DSCR loan to grow my real estate portfolio?

A13: Investors can use DSCR loans to acquire properties that generate sufficient rental income to cover debt obligations. Over time, they can refinance to extract equity and reinvest in additional properties, leveraging their portfolio growth.

Q14: What is the role of rental income reports in DSCR loans?

A14: Rental income reports, like those from AirDNA, provide estimates of the potential rental income a property can generate. Lenders use these reports to assess whether the property will cash flow sufficiently to qualify for a DSCR loan.

If you have any more questions or need assistance with DSCR loans, feel free to contact us. Our team is here to help you navigate the process and make informed investment decisions.